EQUITABLE LIFE MEMBERS

INTERESTING QUESTIONS AND ANSWERS

See also

If Equitable went into administration, an independent actuary would be asked to advise the administrator on the amounts guaranteed to policyholders.

If, for example, the actuary thought the group had been too generous in the annual bonuses it had allocated to policyholders, the administrator might reduce those amounts.

So it could be 90% of a lower figure.

If you have a bond, you would be covered for the first £30,000 in full and then 90% of the next £20,000. The maximum amount of compensation is therefore £48,000.

For with profits annuitants, what would happen if Equitable became insolvent?

The FSCS, which took over from the Policyholders Protection Board last December, admits no one has yet had a good look at annuities. But in the hypothetical case of a life insurer going bust - no one has yet defaulted - the most likely course is that the liquidator would set out a claim on the FSCS.

The value of the annuity would have to be calculated on the basis of how much it would cost to buy the present income at current age. Then, in all probability the annuitant would receive 100% of the first £2,000 and 90% of the balance of this lump sum. This will not replace the income in its entirety.

Initially the expenses of the administrator would have to be paid.

Next in line are the priority or secured creditors, such as banks, major lenders and mortgage lenders, if any property is mortgaged.

Staff are paid - up to a certain level - before ordinary creditors, including policyholders. The FSCS said pensions in payment and new claims are the priority, although the liquidator may take a different view.

Who owns the Unit Linked Fund Equitable or the Halifax?

Although Equitable planned to sell the Unit Linked Fund to the Halifax in 2001, due to complexities of transfers that were allowed between the with profits and unit linked it was decided not to go ahead with it. The Unit Linked is still owned by Equitable and can be seen in the accounts. It is however ring fenced from the With Profits Fund.

The FSA

have written: Technically, if Equitable Life became insolvent you would

become a creditor of Equitable. As such, the liquidator of Equitable

would be required to deal with any claim your client had in the same way

they would deal with a claim from any other creditor.

However, Halifax Life have confirmed that, whatever the legal position of

the unit linked funds, if Equitable's with profits fund were ever to

become insolvent, Halifax Life would stand behind the unit-linked funds

and policies and would be paid in full.

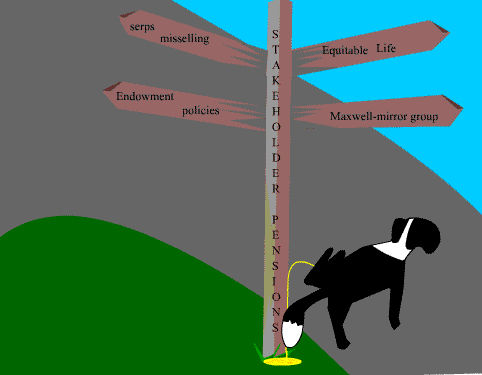

Why is Equitable Life different?

Thus, Equitable was expected to pay the difference between what it guaranteed and what was available. But, because it could not predict the lifespan of its policyholders or future interest rates, the problem became unresolvable.

The lower interest rates went, the bigger the expense for the Equitable. It has revealed that the cost of the GARs has been rising by £200m for every 0.5% drop in interest rates.

For anything below 8.5% the Equitable was expected to find the extra funds. Added to this is the fact that the Equitable has honoured its promises to investors with the result that it has smaller reserves than other insurers.

The Guaranteed Annuity Rate Action Group was made up of policyholders formed in 1998 and took the Equitable to court after it refused to pay these terminal bonuses. A High Court judgement in 1999 backed the Equitable’s stance. But, the Court of Appeal in January 2000 ruled against Equitable's proposed solution and in June, the House of Lords ruled that the company must honour the guarantees of income made when the 90,000 customers took out their policies.

After losing the court case the Equitable decided to put itself up for sale, in order to get money to rescue the GARs. The Prudential toyed with the idea of buying it but pulled out, claiming it was not in the interests of its shareholders or policyholders. The Halifax has however made a deal to buy the workforce and the systems but not the with-profit fund as yet. If it does decide to buy the GARs, it will cost it £250m.

In January 2002 Equitable policyholders approved the compromise scheme to end the society's liability to its guaranteed annuity rate policyholders (GARs). Equitable needed the support of 75% by value of all policyholders who voted and 50% by number. Each proposal was passed by majorities of between 97.3% and 99.2%. The scheme became binding on 8 February 2002 and GAR policyholders should have been written to regarding the payment of the uplift in their policies.

If your policy was cancelled before that date, so you were no longer a with-profits policyholder on the effective date, any potential claim you might have has not been affected by the scheme. The Society has now received the B&W Deloitte report which says that there was mis-selling and will be setting up a S425 Compromise scheme for those who terminated policies between 20 July 2001 and 8 Feb 2002. This should be available later in the year and should come into place 2003.